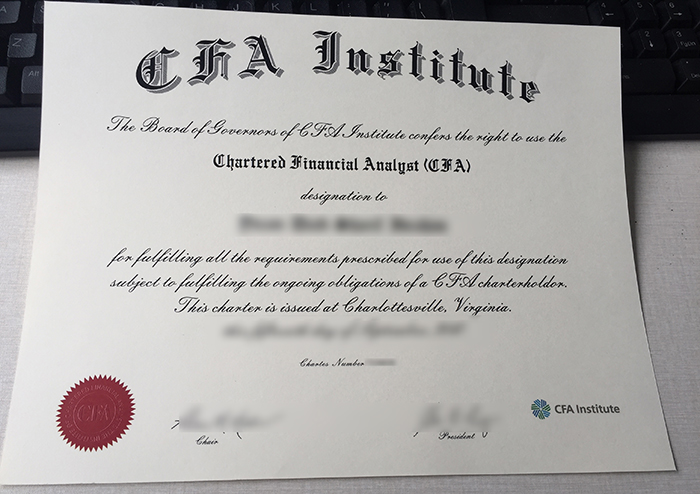

그리고 Chartered Financial Analyst (CFA) designation is a professional certification awarded by the CFA Institute (CFA Institute) in the United States. Buy a CFA Certificate online. Make a CFA Certificate. It is recognized as one of the most prestigious and valuable professional qualifications in the global investment management industry, known as the “entry ticket to Wall Street” and the “gold standard” of finance. It is more than just a certificate; it symbolizes professional knowledge, professional ethics, and a lifelong learning spirit. Buy a certificate online.

1. Extremely High Professional Requirements and a Rigorous Certification System

Obtaining the CFA designation is an extremely challenging process, primarily characterized by three key aspects:

Broad and In-Depth Knowledge: The CFA curriculum covers all aspects of financial investment, including ten core areas: ethics and professional standards, quantitative analysis, economics, financial statement analysis, corporate finance, equity investing, fixed income, derivatives, alternative investments, and portfolio management. This comprehensive knowledge base provides practitioners with a solid and comprehensive foundation in financial theory.

The Level 3 Exam is Difficult: Candidates must pass three levels of the exam in sequence. Each level of the exam is renowned for its breadth and depth, particularly Levels II and III, which focus on the practical applications of asset valuation and portfolio management. Pass rates have historically been low, requiring hundreds of hours of study.

Strict Work Experience Requirements: After passing all three levels, applicants must possess at least four years of relevant professional experience before they can apply for the charter. This ensures that CFA charterholders possess both a solid theoretical foundation and practical skills.、

Buy a CFA Certificate online, buy a fake certificate

II. Core Values and Career Advantages

The CFA charter offers significant core competitive advantages:

Global Recognition: The CFA designation is highly sought after by employers worldwide, particularly in developed financial markets in Europe and the United States and emerging markets in Asia. It serves as a gateway to core positions at top investment banks, fund management firms, securities firms, commercial banks, and other institutions.

Excellent Professional Knowledge: Systematic study equips charterholders with the ability to handle complex investment issues, conduct in-depth financial analysis, and make independent investment decisions.

High Ethical Standards: The CFA program prioritizes ethics and professional standards, requiring charterholders to prioritize the interests of their clients. This emphasis on professional ethics earns charterholders the trust of the market and clients, and builds personal brand credibility.

III. Suitable Citizens and Career Development

The CFA charter is particularly well-suited for professionals aspiring to pursue careers in investment analysis, asset management, wealth management, and research. Common career paths include investment analyst, fund manager, research director, and financial advisor. For financial professionals seeking to advance their professional skills, achieve a career leap, or enter the international financial market, the CFA exam is a valuable path.